what percent of tax is taken out of paycheck in nj

21 hours agoFederal Income Tax Brackets 2022. That is a 10 rate.

How Do State And Local Individual Income Taxes Work Tax Policy Center

Form NJ-1040 - Individual Income Tax Return.

. Form NJ-1040 is the general income. Starting with tax year 2018 you can now deduct up to 15000 of property. Only the very last 1475 you earned.

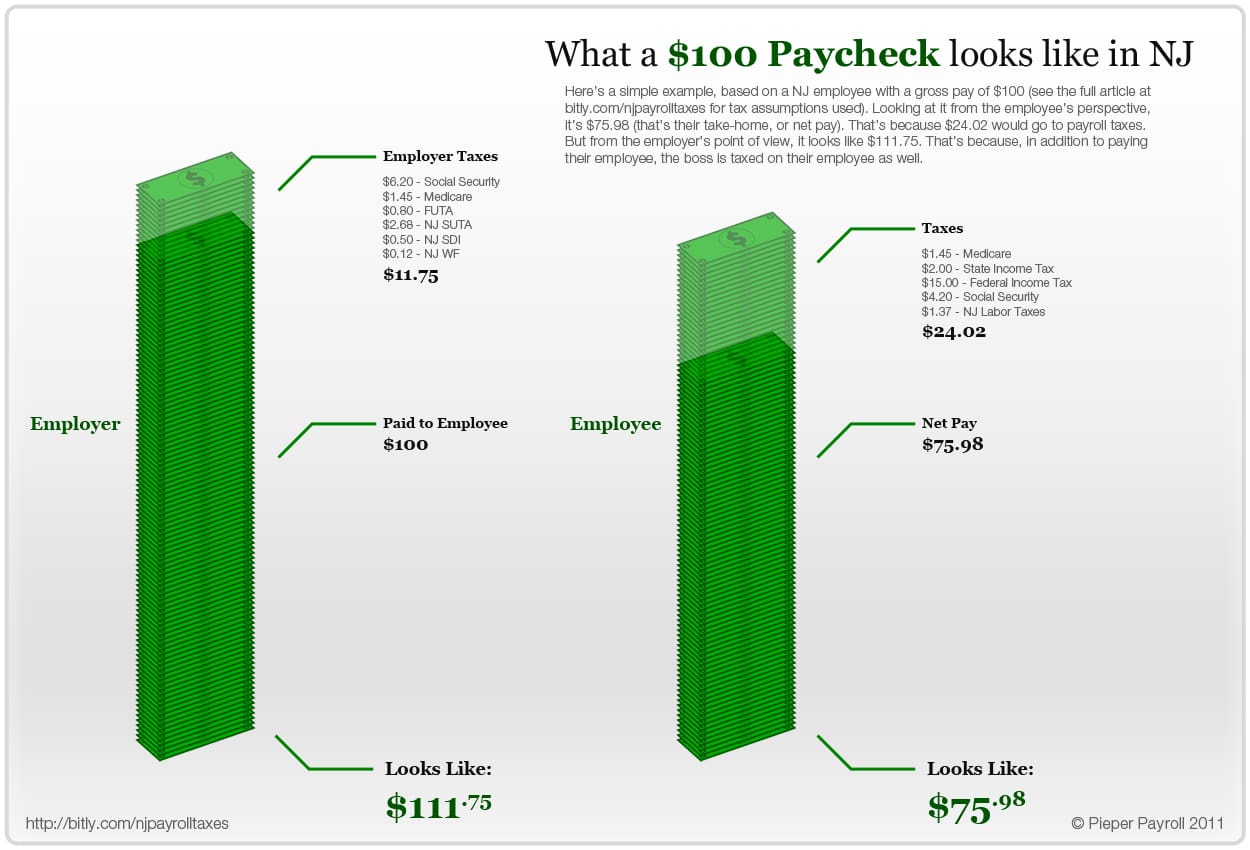

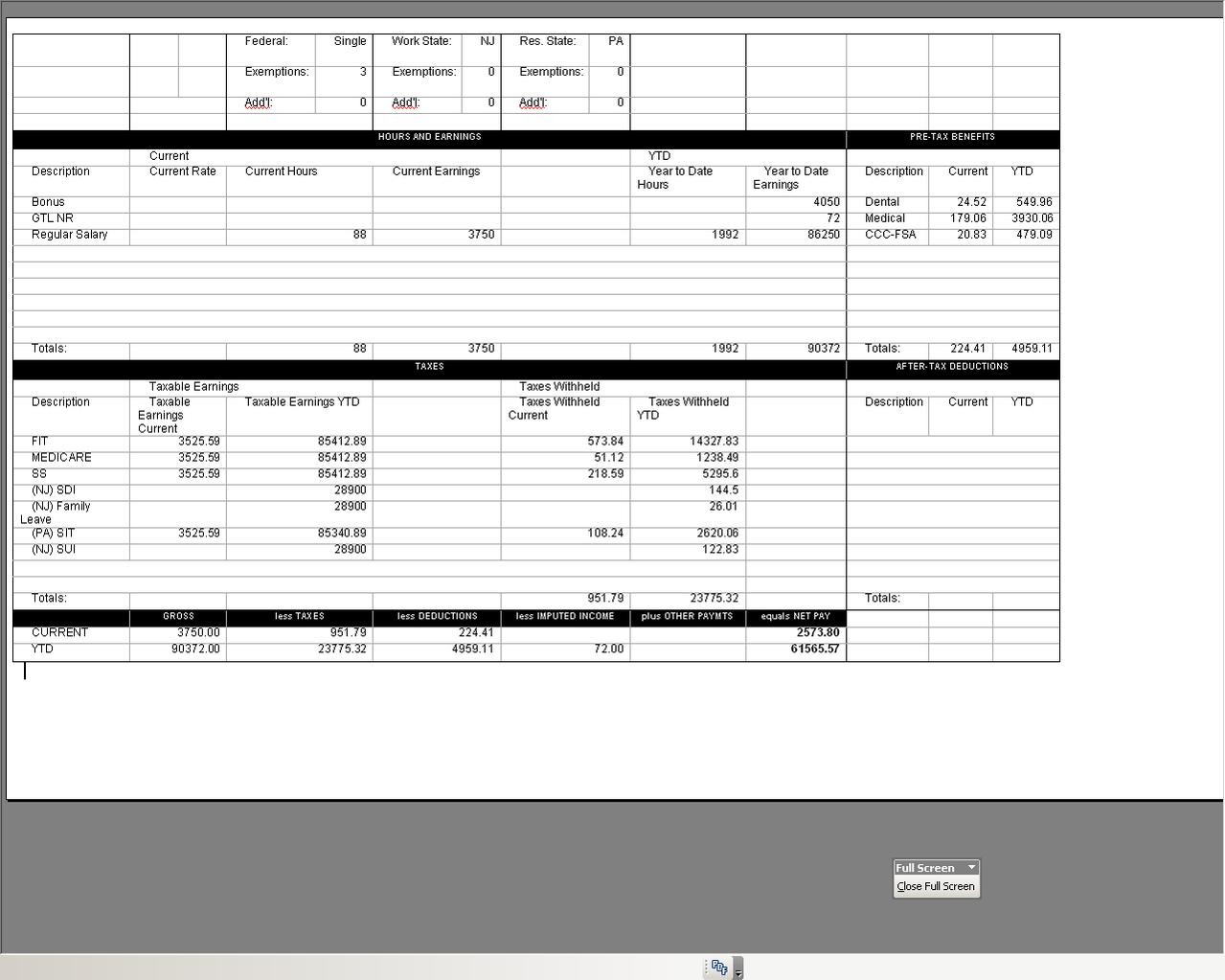

NJ Taxation Effective January 1 2020 the tax rate on that income bracket increases from 897 to 1075 regardless of filing status. New Jersey paycheck calculator. Dear There is no set percentage for NJ state withholding it works like Federal withholding---meaning that there are withholding formulas and generally the more money earned in a pay.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Jersey. How Your New Jersey Paycheck Works. Just enter the wages tax withholdings.

Well do the math for youall you need to do is. New Jersey Hourly Paycheck Calculator. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

Pa state taxes are taken out of my paycheck. You fill out a pretend tax return and calculate that you will owe 5000 in taxes. You can have 10 in federal taxes withheld directly from your pension and.

What is the NJ tax rate for 2020. Federal income taxes are also withheld from each of your paychecks. This New Jersey bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

Any wages earned above 147000 are exempt. You still need to pay federal income tax on top of this. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up.

Nj taxation effective january 1 2020 the tax rate on that income bracket increases from 897 to 1075 regardless of filing status. How much do you. Your employer uses the information that you provided on your W-4 form to.

For Social Security withhold 62 of each employees taxable wages until they have earned 147000 for the year. If you need to file Form NJ-1040-ES reference this booklet to help you fill out and file your taxes. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

New Jersey income tax rate ranges from 140 to 1075 and there are also three types of payroll taxes. As mentioned above property taxes are usually tax deductible on your New Jersey income tax return. For a single filer the first 9875 you earn is taxed at 10.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

State Income Tax Rates Highest Lowest 2021 Changes

Pay Stub Meaning What To Include On An Employee Pay Stub

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

New Jersey Paycheck Calculator Smartasset

Nj Division Of Taxation Employer Payroll Tax

Different Types Of Payroll Deductions Gusto

Salary Paycheck Calculator Calculate Net Income Adp

New Jersey Income Tax Calculator Smartasset

California And New Jersey Hsa Tax Return Special Considerations

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

Llc Tax Calculator Definitive Small Business Tax Estimator

What Are Employer Taxes And Employee Taxes Gusto

What Are Employer Taxes And Employee Taxes Gusto

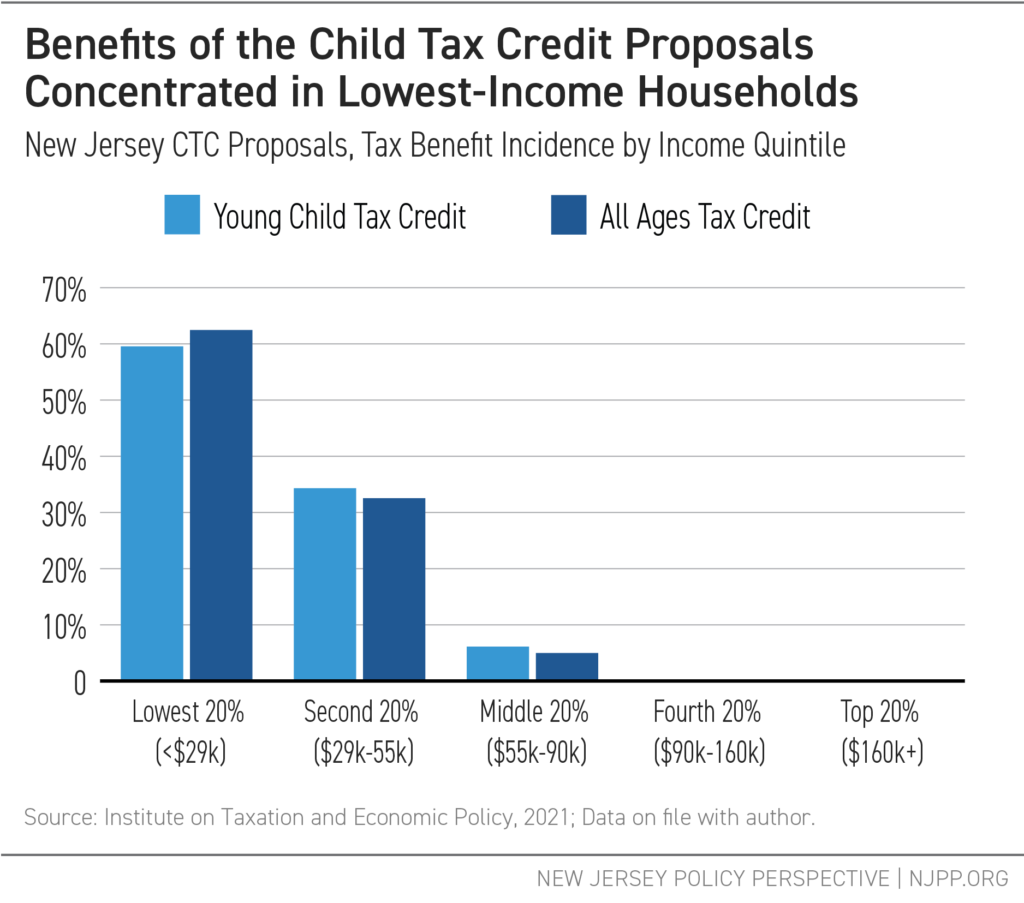

Report Archives New Jersey Policy Perspective

Paycheck Calculator New Jersey Nj Hourly Salary

What To Do When Employee Withholding Is Incorrect

Nj To End Temporary Work From Home Tax Rules Nj Spotlight News

Government Will Take Almost Half Your Paycheck In 2013

![]()

New Jersey Paycheck Calculator 2022 With Income Tax Brackets Investomatica